The CPI increased 0.1 percent in November and 3.1 percent from a year ago. The energy index dropped 2.3 percent, fueled—no pun intended—by a 6.0 percent decline in gasoline prices. Motorists got major relief at the gas pump. Food prices increased 0.2 percent in November while food away from home jumped 0.4 percent.

Overall, last month rent, owners' equivalent rent, medical care, and motor vehicle insurance increased. Prices fell for apparel, household furnishings and operations, communication, and recreation among other goods and services.

If food and energy prices are omitted from the CPI, remaining prices rose 4.0 percent from a year ago. In other words, making ends meet for most families is still a challenge.

However, the Sticky Consumer Price Index Less Food and Energy rose 4.93 percent from a year ago. According to the St. Louis Fed, “The Sticky Price Consumer Price Index (CPI) is calculated from a subset of goods and services included in the CPI that change price relatively infrequently. Because these goods and services change price relatively infrequently, they are thought to incorporate expectations about future inflation to a greater degree than prices that change on a more frequent basis. One possible explanation for sticky prices could be the costs firms incur when changing price.”

Thus, annual “core inflation” of nearly 5 percent is far from the than the Fed’s goal of 2 percent inflation.

The implication is that the Fed will not lower interest rates any time soon because price inflation is still entrenched in the economy. Whether the Fed will raise interest rates Wednesday to help bring inflation in line with its 2 percent goal remains to be seen.

With the stock market on a tear since the end of October coupled with the substantial rise in housing prices the past few years, the so-called wealth effect has lifted the net worth of the American people.

The last thing the Fed would like to see is Americans go on a spending spree, which would cause prices to increase more than current price inflation.

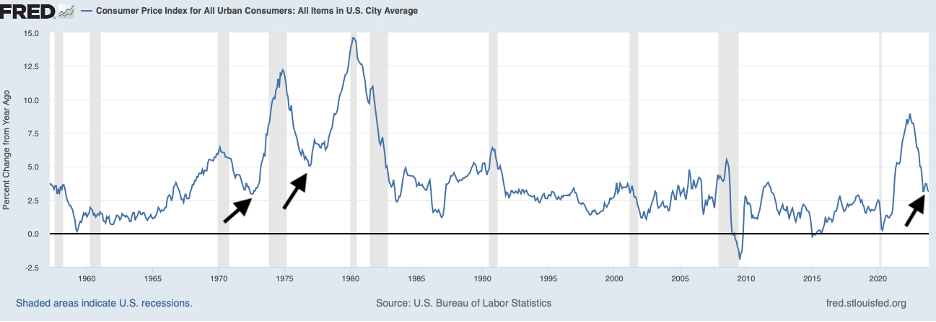

As far as price inflation in 2024 and beyond we could see inflation “stabilize” at these levels and then jump during the last inflation cycle from the 1960s to the early 1980s.

The next few years could see a repeat of the “stop and go” inflation of decades ago.