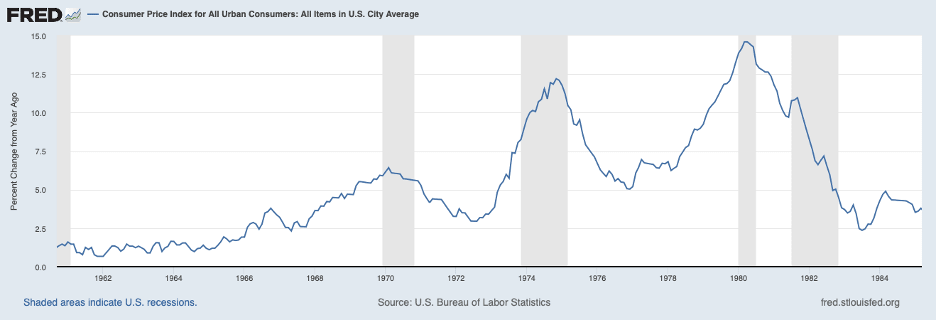

Most Americans were not alive during the last multiyear inflation cycle (1965-1982). Inflation accelerated coinciding with President Johnson’s escalation of the Vietnam War and the initial phase of his Great Society spending spree. The Federal Reserve pumped up the money supply and we were off to the races. The inflation cycle had three up cycles each lasting a few years peaking in 1981.

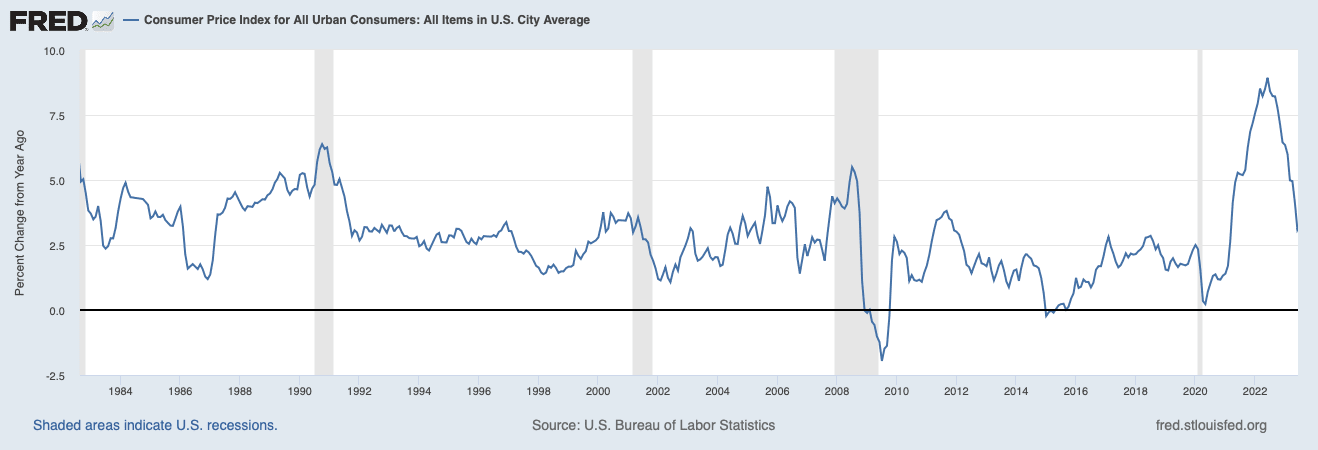

For the next 40 years inflation was relatively subdued with several spikes until the CPI hit 9 percent in 2022 and has since decelerated but still higher than the Fed’s 2 percent “target.”

The geniuses at the Fed do not understand that in a free-market prices decline, i.e., “natural deflation.” In other words, the Fed’s money printing is keeping prices from declining, which is the primary way the public increases their living standards.

Wages flat, prices decline, purchasing power of the dollar increases. Instead, the Fed’s endless money printing causes average American families to be squeezed by higher price.

I believe we are in a long-term inflation cycle, which began in 2020 and could last a decade or more. We are not out of the woods by any means despite the CPI having decelerated sharply recently.

However, yesterday’s WSJ explains why inflation is “sticky,” and is about to accelerate. Higher inflation has enormous impacts on stocks, bonds, real estate, commodities and other financial assets. The good news is that entrepreneurs are not deterred despite the Fed’s destabilizing policies and will continue to provide us with goods and services we want. The bad news the Fed will continue to manipulate interest rates and print money. I will continue to monitor the monetary and financial conditions to provide forecasts of upcoming economic activity.

******************************************************************************

My latest piece on the economy was published in Fortune, https://fortune.com/2023/03/27/recession-2023-layoffs-tech-finance-unemployment-outlook-fed-rates-murray-sabrin/ This is an update of my 2021 forecast, https://fortune.com/2021/12/09/next-recession-heres-everything-bubble-markets-2021-2022-covid-murray-sabrin/

*****************************************************************************

Murray Sabrin, PhD, is emeritus professor of finance, Ramapo College of New Jersey. Dr. Sabrin is considered a “public intellectual” for writing about the economy in scholarly and popular publications. His new book, The Finance of Health Care: Wellness and Innovative Approaches to Employee Medical Insurance (Business Expert Press, Oct. 24, 2022), and his other BEP publication, Navigating the Boom/Bust Cycle: An Entrepreneur’s Survival Guide (October 2021), provides decision makers with tools needed to help manage their businesses during the business cycle. Sabrin's autobiography, From Immigrant to Public Intellectual: An American Story, was published in November, 2022.