The BLS reported this morning that prices rose .02 percent in July from a month earlier and 3.2 percent from a year ago. Excluding food and energy, prices rose 4.7 percent from a year ago and .02 percent in July.

The 12.5 percent drop in energy prices from a year earlier has been a boon to motorists, especially the 19.9 percent decline in gasoline prices. The pain at the pump has become less painful. However, motor vehicle insurance rose a whopping 17.8 percent from a year ago, while airline fares dropped 18.6 percent and shelter rose 7.7 percent. In other words, some prices within the CPI fall while others increase at rates well above the CPI. Thus, how much is due to the Fed’s money printing and how much is due to supply and demand in specific sectors takes a bit of investigation.

What we do know is that the Fed’s money printing sets into motion higher prices in general while some sectors are affected more than others during an inflation cycle.

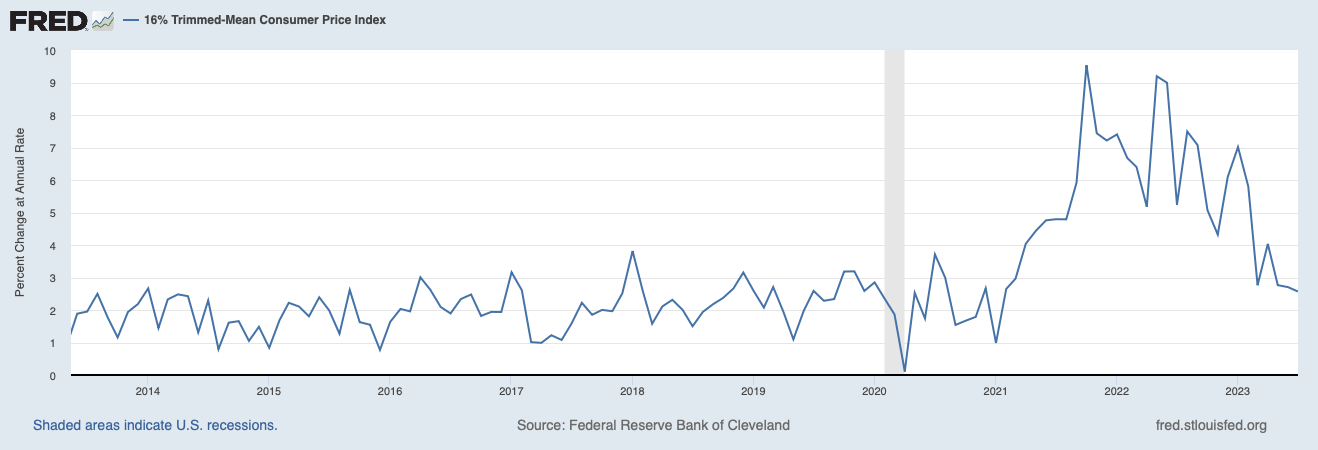

Another look at price inflation is the 16% Trimmed-Mean Consumer Price Index. What is this? You probably never heard of it because the media do not report it.

“16% Trimmed-Mean Consumer Price Index (CPI) is a measure of core inflation calculated by the Federal Reserve Bank of Cleveland. The Trimmed-Mean CPI excludes the CPI components that show the most extreme monthly price changes. This series excludes 8% of the CPI components with the highest and lowest one-month price changes from each tail of the price-change distribution resulting in a 16% Trimmed-Mean Inflation Estimate.”

The graph latest graph reveals the deceleration of inflation from the lofty levels of 2022 and shows that inflation year over year is down to 2.6 percent.

This begs the question: Will price inflation stay in the 2-3 percent range for the foreseeable future? Not to be wishy-washy, the decline in the money supply for the past eight months explains the deceleration in price inflation. But more importantly, the steep drop in the supply of money and the Fed’s increase in interest rates for more than 18 months signals a recession is beginning to unfold.

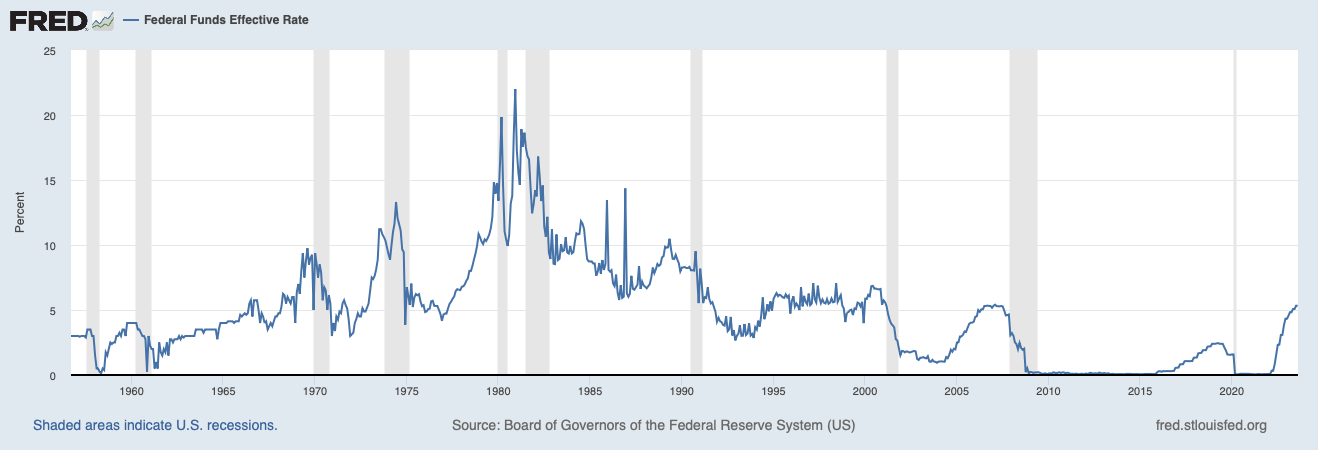

Once the recession takes hold, expect the Fed to lower interest rates as it always has done in past boom-bust cycles. If the Fed keeps rates up, the economy will chug along until economic activity contracts and the unemployment rate ticks up, and that’s when the Fed then floods the country with new money to “stimulate” the economy.

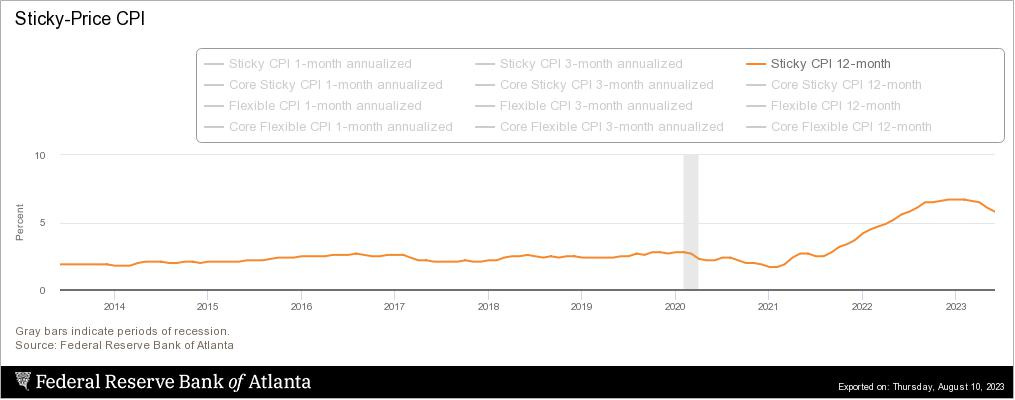

In the meantime, prices remain “sticky,” especially in the services sector. This index is up 5.5 percent from a year ago. Typically, consumer prices increase slowly during a recession as some prices drop substantially, but with trillions of new dollars still in the economy because of the Fed’s quantitative easing during 2020, we are in uncharted waters.

My latest piece on the economy was published in Fortune, https://fortune.com/2023/03/27/recession-2023-layoffs-tech-finance-unemployment-outlook-fed-rates-murray-sabrin/ This is an update of my 2021 forecast, https://fortune.com/2021/12/09/next-recession-heres-everything-bubble-markets-2021-2022-covid-murray-sabrin/

*****************************************************************************

Murray Sabrin, PhD, is emeritus professor of finance, Ramapo College of New Jersey. Dr. Sabrin is considered a “public intellectual” for writing about the economy in scholarly and popular publications. His new book, The Finance of Health Care: Wellness and Innovative Approaches to Employee Medical Insurance (Business Expert Press, Oct. 24, 2022), and his other BEP publication, Navigating the Boom/Bust Cycle: An Entrepreneur’s Survival Guide (October 2021), provides decision makers with tools needed to help manage their businesses during the business cycle. Sabrin's autobiography, From Immigrant to Public Intellectual: An American Story, was published in November, 2022.