Last week the Federal Reserve announced it would continue to hold interest rates steady as it assesses inflation and other data to determine how much liquidity the economy needs to meet its dual mandate of price stability and low unemployment.

According to the Fed’s view, 2 percent inflation is price stability. In other words, 2=0. However, in a free-market economy prices decline gently as more goods and services are produced. In addition, the Fed believes it can “thread the needle” and avoid inflation and recession by targeting the fed funds rate, which is now in range of 5.25-5.50 percent.

The Fed is preventing the public from enjoying the benefits of a free market economy—lower prices--by pumping in new money that prevents most prices from declining.

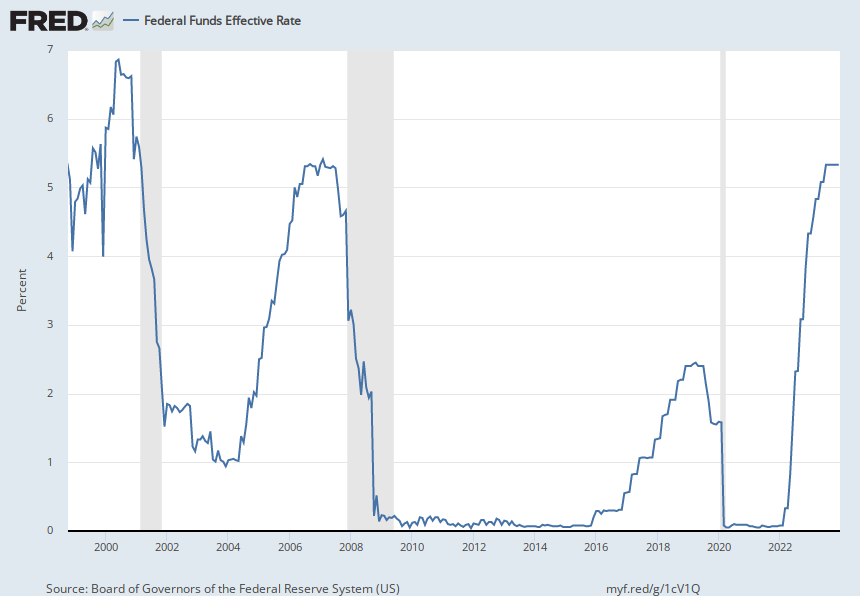

The Fed has been manipulating interest rates for decades causing the boom bust cycle (the gray bars are periods of recession). When Fed chairman Jerome Powell hinted last week at his press conference that the fed funds rate would decline several times next year, the stock and bond markets rallied strongly. However, history reveals when the Fed starts lowering interest rates the economy is in or going into a recession—a necessary period to eliminate the “excesses” of the easy money boom.

Murray Rothbard explains how interest rates and prices would behave in a free market. Every Federal Reserve official and all the staff economists should read this monograph and conclude if they have any brains the Fed should stop manipulating interest rates and stop creating money out of thin air.

In today’s Wall Street Journal, Nick Timiraos cites the concern of San Francisco Fed President Mary Daly who believes the Fed may “overtighten” next year and thus raise real interest rates. Translation: the Fed wants to keep real interest rates, the rate savers get after inflation, close to 0.5 percent, depriving savers a higher real rate of return on their money market accounts and other savings vehicles.

In the textbook I used in my corporate finance course and in the ones I reviewed for publishers, the chapter on interest rates always mentioned that historically the real interest rates on bonds and other fixed income investments is typically 2-3 percent.

So why does the Fed want to shortchange savers? Why is that question never asked of the Fed chairman during the press conference after the Fed announces its interest rate decision?

This reveals how economic journalists are focused on the Fed’s manipulation of interest rates as a proper tool to “guide” the economy. They too should read Rothbard’s monograph.

Will 2024 be a boom or bust in the stock market? I will review the evidence in an upcoming essay..

“There is a right way and a wrong way, always choose the right way.” Abraham Sabrin (1914-2001) “Prediction is very difficult, especially if it’s about the future!” Niels Bohr

Every Wednesday at 11:05am talk show host Gary Nolan and I discuss the economy and politics. The Fort Myers Mises Circle presentations are available online.

Latest podcast on healthcare with host Johnathan Westover; Incentivizing wellness podcast with Bernadette Pajer; the Human Action podcast with Bob Murphy; Joseph Cotto and I discuss Argentina and the US