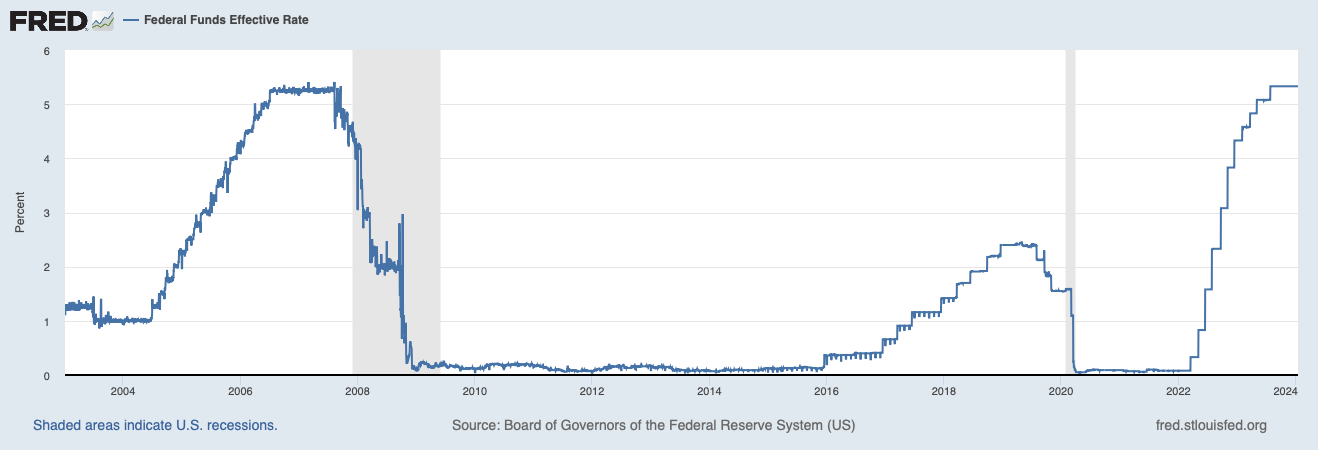

A recession/depression is inevitable after the Federal Reserve lowers interest rates to “stimulate” the economy creating an unsustainable boom. That has been the pattern of the boom/bust cycle since the Fed was created in 1913.

The current boom/bust cycle is no different. The Fed lowered interest rates (fed funds rate) to virtually zero in 2020 in response to the Covid lockdowns. Previously, the Fed’s monetary stimulation after the Great Recession ignited the boom that was beginning to unwind when interest rates began rising prior to Covid.

I explain all the economic ramifications of the Fed’s manipulation of interest rates in my Navigating the Boom Bust Cycle.

In the meantime, Ryan McMaken provides proof that a recession is in its early stages. Typically, the Fed would lower interest rates when it becomes obvious to the Fed policymakers that the economy needs to be “stimulated” to boost production, consumption, and employment.

In other words, the Fed creates the boom, the recession is when the economy is eliminating the distortions created by easy money. And the cycle keeps being repeated.

At some point the money printers at the Fed will have to decide to do the right thing, namely, stop manipulating interest rates and printing money. Wall Street thrives on cheap money so don’t expect the End the Fed chants coming from the canyons of lower Manhattan.

To learn more about the Fed and its policies the Mises Institute is having a one-day session in Tampa on February 17.

If you would like to attend as my guest (no fee for the morning and afternoon events), email me with your name and town. The first 10 people to sign up will get an opportunity to hear insightful presentations about the Fed and inflation.